FIA EPTA survey: Half of European market makers provide liquidity in ESG products

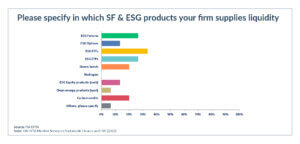

Around half of European market-making firms surveyed by FIA European Principal Traders Association (FIA EPTA) are actively providing liquidity in ESG financial products, playing an important role in the global transition to sustainable investing. FIA EPTA, which...

Sustainable Finance Paper I: “Enabling the Transition”

FIA EPTA members are committed to supporting the transition towards a greener and more sustainable financial services sector that supports the common goals of net neutrality in 2050. We understand the importance of sustainable finance in achieving this goal, which...

Delivering on sustainability goals requires a move away from traditional investment approaches

Piebe Teeboom, Secretary General of the European Principal Trades Association (FIA EPTA), details the findings of a new report on sustainable finance from the perspective of global asset managers. The study reveals the need for a broader concept of ‘value’ – which...

Redefining Value in ESG – Download The Report

Growing public appetite for more sustainable investment is being held back by traditional approaches to investment – a new study of global asset managers reveals. Consequently, the policymakers’ goal towards creating a greener and more sustainable economy risks...

Time To Move Away From Traditional Investment Approaches If We Want To Deliver Sustainability Goals – New Report Of Global Asset Managers

New report reveals need for a broader concept of ‘value’ – which requires new ways to manage the ‘myriad of data’ and ensure trust in ESG assets. GROWING public appetite for more sustainable investment is being held back by traditional approaches to investment – a...

LATEST

LATEST