FIA EPTA survey: Half of European market makers provide liquidity in ESG products

Around half of European market-making firms surveyed by FIA European Principal Traders Association (FIA EPTA) are actively providing liquidity in ESG financial products, playing an important role in the global transition to sustainable investing.

FIA EPTA, which represents Europe’s leading independent market making firms, conducted the survey in February, with 19 of its 24 member firms across Europe (EU and UK) participating. FIA EPTA members function as key liquidity providers for exchange-traded and cleared markets, meaning that they post bids /offers and quotes to trading venues on a continuous basis.

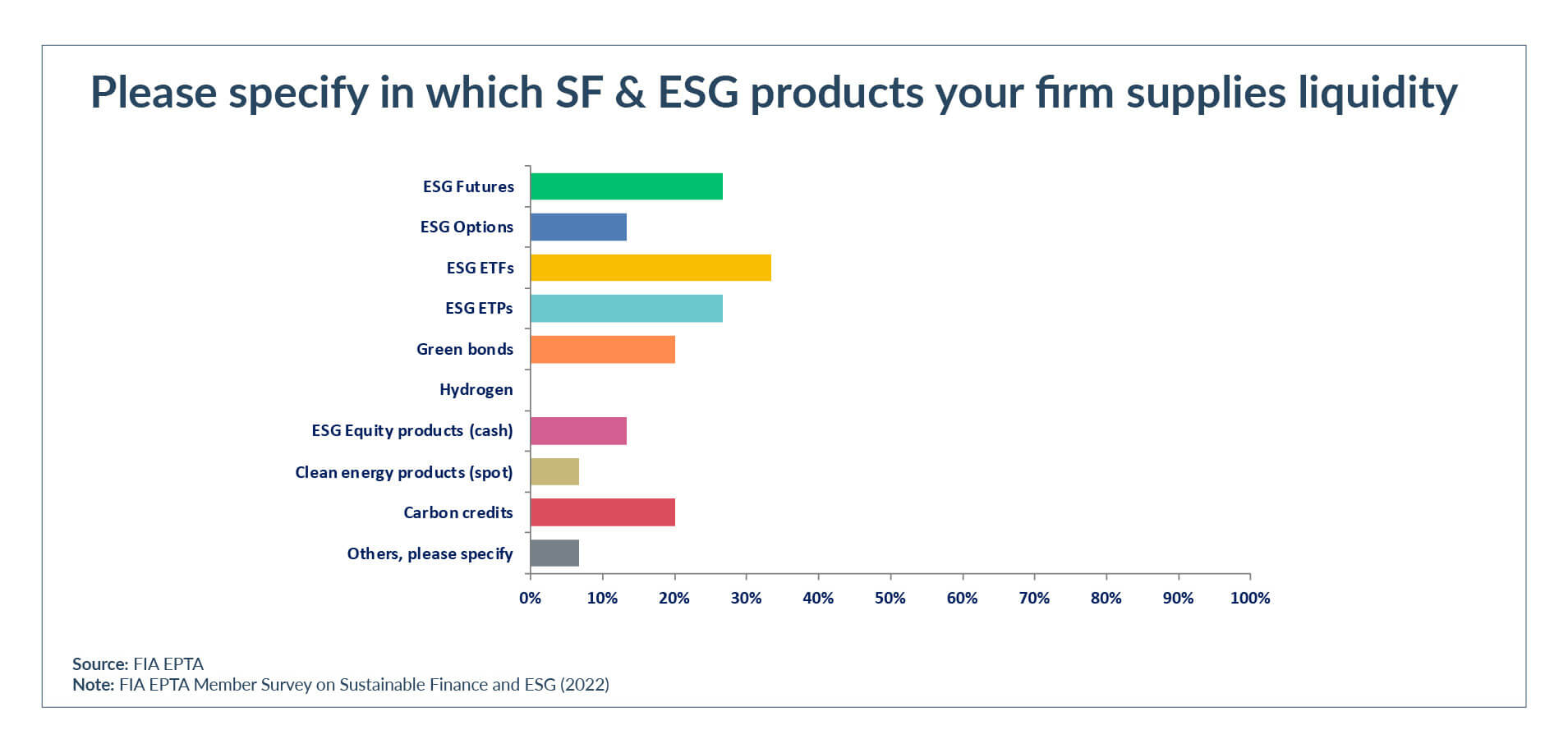

Respondents to the survey saw the most demand for liquidity from investors in ESG exchange-traded funds (ETFs). That marked a change from its previous survey which FIA EPTA conducted a year ago, when there was greater demand for liquidity for futures based on ESG indices.

The market making firms surveyed are active on a wide range of venues listing ESG products, with Euronext, the London Stock Exchange Group, Deutsche Börse / XETRA and Eurex being the most popular venues among respondents. Other survey findings show that half the firms have been approached by exchanges for support on new ESG products, although only 12% have been approached by clearing banks or buy-side participants.

The market making firms surveyed are active on a wide range of venues listing ESG products, with Euronext, the London Stock Exchange Group, Deutsche Börse / XETRA and Eurex being the most popular venues among respondents. Other survey findings show that half the firms have been approached by exchanges for support on new ESG products, although only 12% have been approached by clearing banks or buy-side participants.

Crucial role in climate goals

The survey follows the release of FIA EPTA’s Principles on Sustainable Finance and ESG in June 2021, and a white paper on the importance of secondary markets for the transition towards sustainable capital markets, published in October 2022. Both set out how independent market makers and liquidity providers can contribute to achieving Europe’s goal of climate neutrality by 2050.

Market makers play a crucial role in the green transition by providing continuous liquidity and making ESG based products more attractive and available to investors. Pricing competitively by showing a tight bid-ask spread helps minimise the cost of investing in such ESG products, which can help investors reorient capital to sustainable investments.

“Market makers continue to be committed to trading ESG products, giving investors the confidence they need to include ESG products in their portfolios and investment strategies,” says Rutger Vijgen, public affairs advisor at FIA EPTA.

“When it comes to new financial products, investors want to be sure that there is always a market for that product. By providing continuous liquidity, market makers guarantee there is always someone providing prices in the market, even in volatile circumstances. This allows investment managers to adjust their portfolios, pursue their trading and investment strategies and manage their risk, at low cost and with ease globally,” Vijgen says.

Market Conditions

According to the survey, market conditions in 2022 triggered by the war in Ukraine and the energy and cost-of-living crises did not affect how market makers view ESG products – with one saying that it had become even more interested in providing liquidity in this area.

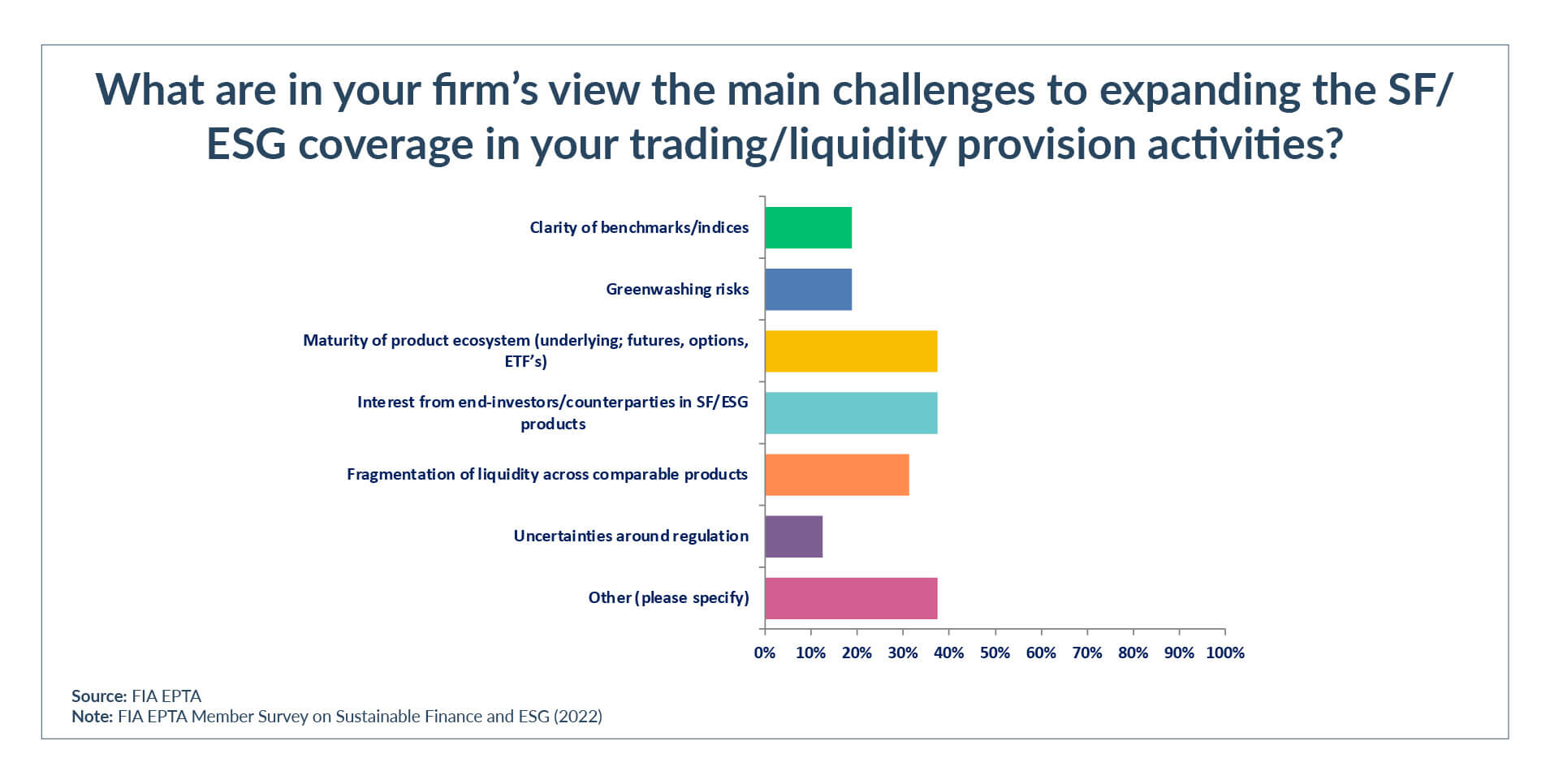

Discussing the main challenges to expanding ESG coverage in their trading/liquidity provision activities, 38% of firms pointed to a lack of interest from end-investors/counterparties in sustainable finance/ESG products, with one firm saying, “The main limitation is waiting for more end-investor interest.”

FIA EPTA members see an absence of transparency and standardisation in ESG ratings and data as a barrier for investors to start or expand trading in ESG products. This is substantiated by a report that FIA EPTA published in 2022 based on interviews with 35 ESG experts from asset managers. FIA EPTA is a strong supporter of the announcements made last year by the European Commission and the UK Financial Conduct Authority to regulate the ESG ratings and data market.

Just under 40% of firms cited maturity of the product ecosystem (underlying futures, options, ETFs) as a challenge, with 32% pointing to fragmentation of liquidity across comparable products.

When it comes to improving their own sustainability performance, two-thirds of the firms surveyed (65%) said they were either carbon-neutral or had started making reductions.

When it comes to improving their own sustainability performance, two-thirds of the firms surveyed (65%) said they were either carbon-neutral or had started making reductions.

“Each year we ensure we are carbon neutral through the purchase of carbon credits. [We are] in process to create a 2050 net zero plan,” one firm said.

More than half of the firms said they had started preparations for potential future disclosure requirements on their ESG strategy, targets, and objectives, with the majority saying they will disclose this information on their website or in their annual reports.

Diversity and inclusion

The survey also included questions about diversity, inclusion, and well-being − a component of the “social” pillar of ESG − and found that all participating firms have diversity, inclusion and well-being policies and practices in place.

Two-thirds of firms surveyed have made changes to their recruitment process to make it more inclusive, and just under 70% of firms have reviewed their remuneration structures to address possible gender pay gaps.