Lockdown restrictions liberated market making firms to reap the benefits of difference

Interview with Ian Firla, Head of Innovation, OSTC Ltd.

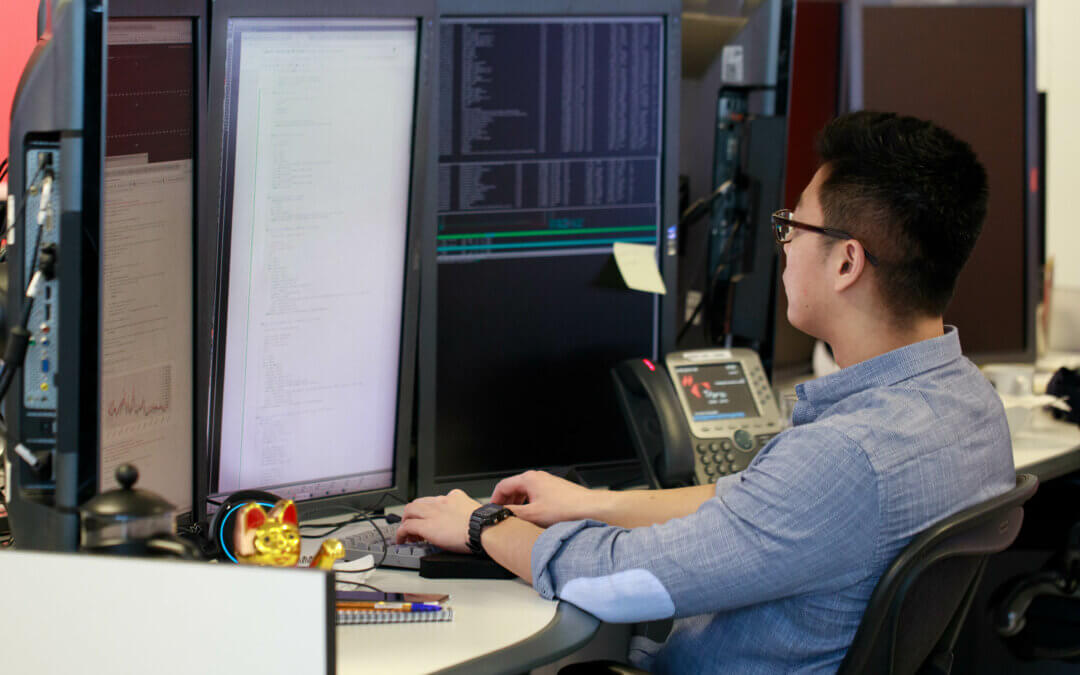

That market making is changing. It’s no longer that image perpetuated by the media and film, of traders in coloured jackets flailing their arms around. Yes, there are a lot of white men in the industry, but you don’t need to be one to take part. It’s really important for people to know that. You need a sharp mind. To be good with numbers. You need to understand risk. And you need a passion for the markets. But beyond that, it doesn’t matter.

There’s a growing focus now in this industry on diversity and inclusion in recruitment, and ensuring everyone has access to the right education opportunities. As a global proprietary derivatives trading firm and educator, I’m proud that OSTC is at the cutting edge of this. It’s a really exciting place to be.

“ You need a sharp mind. To be good with numbers. You need to understand risk.

And you need a passion for markets making may have several beneficial effects on markets. But beyond that, it doesn’t matter.”

Q. The first of FIA EPTA’s thought leadership reports for the campaign looks at how liquidity, and market making, changed during the pandemic. What effects did the pandemic have on you and the team at OSTC?

It’s been quite interesting to observe the impacts of the pandemics on the markets. There have been issues of liquidity, for sure. Though in our own experience, these have perhaps not been as profound as they have been for others.

But what we have found is that the pandemic has really emphasised the point that anyone can trade and do their job from anywhere. OSTC has had a programme allowing anyone to work from home, and we have found that it has really expanded and extended our latest recruitment drives. People who have been trained remotely, and developed remotely, are now operating as market makers and liquidity providers remotely.

In this respect, the pandemic has helped to emphasise that a well-trained and well-risked individual can do his or her job from anywhere. And that really liberates firms like ours to be able to recruit the best talent, and inject the best liquidity into the markets, from anywhere.

“The pandemic has helped to emphasise that a well-trained and well-risked individual can do his or her job from anywhere. And that really liberates firms like ours to be able to recruit the best talent, and inject the best liquidity into the markets.”

The human touch is extremely important in market making. It’s exactly why we have such a focus on recruiting diverse talent. If you have a group of people in your team who all think the same way, and are hoping to do the same thing, they will programme algorithms in the same way too. They will all point in the same direction.

The greater diversity of people you have within your team, the more creativity you get, and the more you are derisking what you do. Because you know that someone will always bring an alternative view point, in a way that they wouldn’t if you were only working with a group of very like-minded individuals. At OSTC we are really reaping the benefits of difference.

Honestly, that has always been curious to me. Market makers are literally performing a function. We are providing liquidity, without which the markets would be a far riskier place for both the buy side and sell side to engage. In fact, the risk being introduced to markets without market makers’ presence would be highly amplified. Market makers help to make markets more stable, more secure, for everyone.

OTSC is a global derivatives trading firm and educator providing liquidity globally on most of the major exchanges. It prides itself in its inclusivity and diversity programmes.

For more information on OTSC visit: www.ostc.com