Market makers see growing demand from investors in ESG exchange-traded funds.

More than half (60%) of European market-making firms surveyed by FIA European Principal Traders Association (FIA EPTA) are providing liquidity in sustainable finance and ESG financial products, playing an important role in the global transition to sustainable investing.

FIA EPTA, which represents Europe’s largest non-bank market makers and liquidity providers, conducted the survey with its member firms last month, with 22 firms across the continent participating. The survey found two-thirds of the firms providing liquidity are looking to expand their activities in the ESG space, with the remainder planning to continue their activities at the current level.

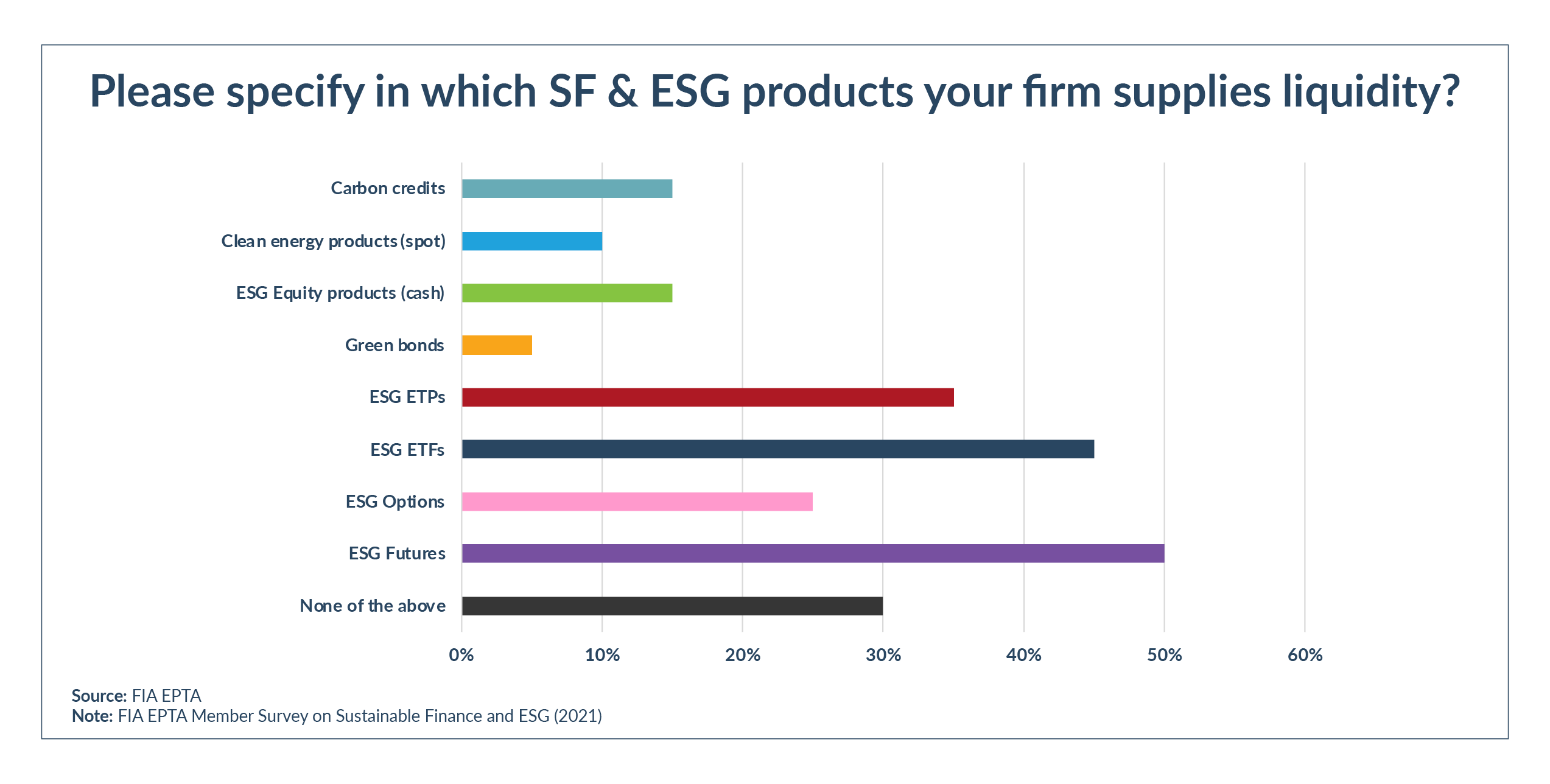

While market making firms surveyed are most active in supplying liquidity in ESG futures (50%), they are starting to see a growing demand from both institutional and retail investors in ESG exchange-traded funds (45%).

The firms are active on a wide range of venues listing ESG products, with Eurex coming out top in the survey (50% of respondents), followed by Deutsche Börse Xetra and Euronext, including Borsa Italiana (45%). A third of the liquidity providers use the London Stock Exchange Group and a quarter is active on SIX Exchange and in bilateral trading.

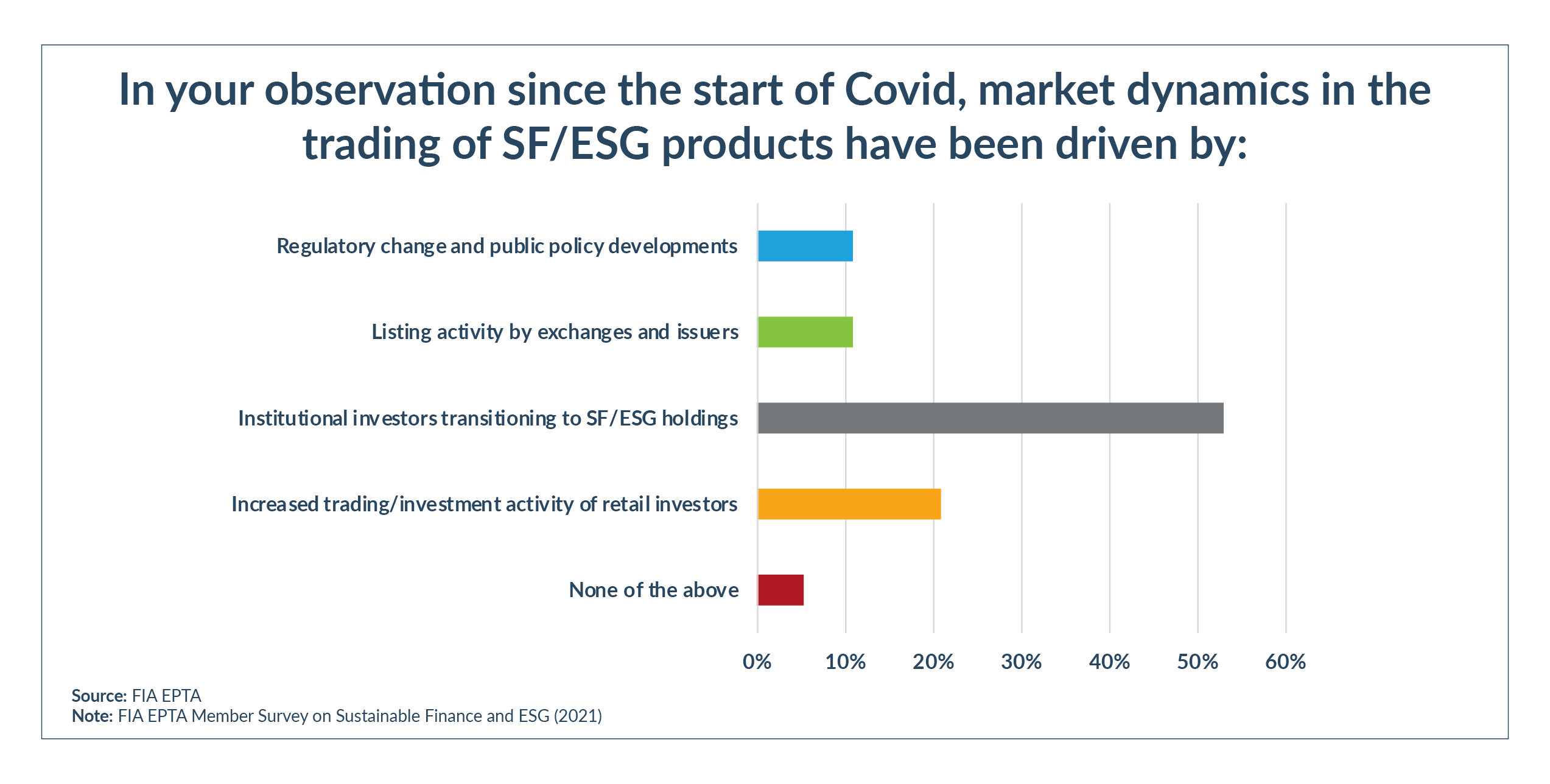

Other survey findings show that since the start of the Covid pandemic, more than half of the firms surveyed (57%) have either been approached by or held discussions with exchanges on sustainable finance and ESG-related issues, and half have been asked to supply liquidity in ESG products.

The survey follows the release of FIA EPTA’s Principles on Sustainable Finance and ESG, published in June, which set out how market makers and liquidity providers can contribute to achieving Europe’s sustainable finance goals.

Market makers play a crucial role in the green transition by providing constant liquidity and making ESG products more attractive and available to other market participants. This helps minimise the cost of investing in ESG products, which can help investors reorient capital to sustainable investments.

“Our members are already putting their commitment to our sustainable finance principles into action, taking active roles in ESG products,” said Rutger Vijgen, public affairs advisor at FIA EPTA. “With market makers committed to trading these products, it gives investors the confidence they need to include ESG products into their portfolios and investment strategies.”

Interest and appetite in ESG products were not reported to be affected by the pandemic – signalling it was an emerging trend which has endured despite Covid rather than be accelerated by it.

A total of 57% of firms said sustainable finance and ESG considerations are now embedded in their processes for identifying new products, reflecting the growing demand from investors for sustainable investment strategies.

When it comes to improving their sustainability performance, nearly two-thirds of the firms surveyed (63%) said they were either carbon neutral or had started making reductions. A further 26% said they were looking at ways to reduce CO2 emissions but had not started implementation.

“To achieve the green transition, financial participants including asset managers, pension funds, and hedge-funds will want to significantly reduce or completely close their holdings in products that, over time, will be deemed ‘brown’,” the association said when it released its principles. “FIA EPTA members can play a vital role in this evolution, making sure there is still a market to sell these products while facilitating a smooth transition towards ‘green’ products.”

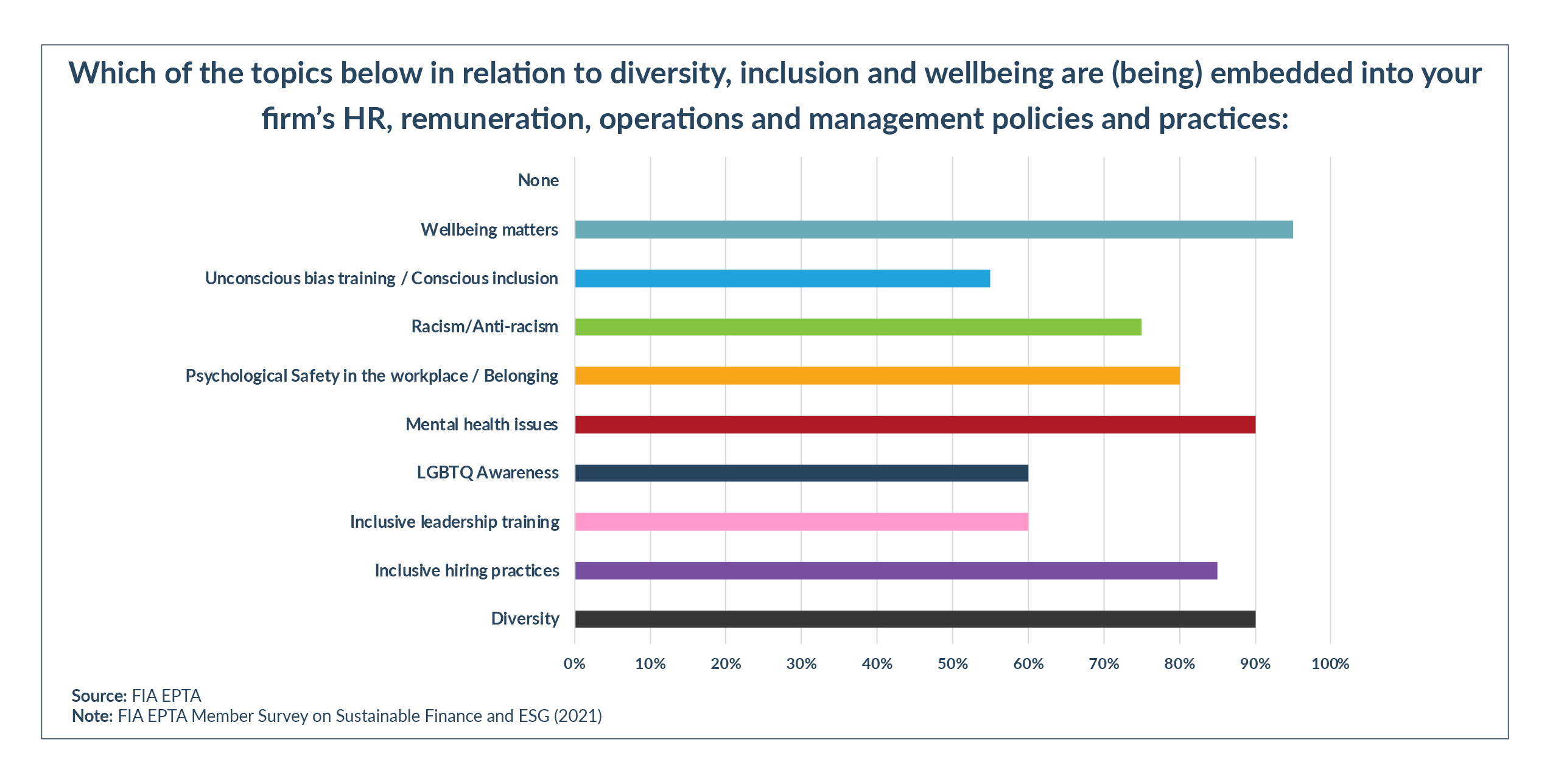

The survey also covered diversity, inclusion and wellbeing − a component of the “social” pillar of ESG − and found:

-

-

- 95% of firms have wellbeing policies and practices in place

- 90% have Diversity policies in place

- 85% of firms have inclusive hiring practices in place

- More than half offer unconscious bias training to staff

- 58% of firms are either reviewing or have finalised remuneration structures to address any possible gender pay gaps

-

In September, FIA EPTA launched a #WeAreMarketMakers campaign to drive greater understanding of what independent market making firms do, and their contribution to both financial markets and the wider economy.

LATEST

LATEST